Inflation in Switzerland fell to 0% (4 photos)

If it drops to a negative value, banks will start paying extra to clients who want to take out a loan. This is not fiction, but reality.

Zero inflation has been recorded in Switzerland. This is good for the country's residents, but not so good for the financial sector. Consumer prices have remained the same compared to April last year or even decreased. Thus, food and soft drinks prices in April fell by 0.8% year-on-year, and clothing and footwear by 0.2%. Health care services also fell slightly in price - by 0.3%, and transportation services - by 2.6%. But housing and energy resources increased in price by 1.4%, communication services - by 1%. Prices in restaurants and hotels also increased slightly (by 1.6%).

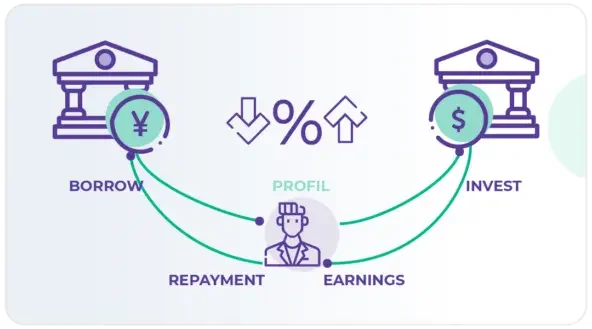

At a meeting in March, the Swiss National Bank (SNB, the country's central bank) was forced to reduce the interest rate to 0.25% per annum. This means that financial institutions will be able to continue to take loans from the Swiss National Bank at almost zero interest. In such conditions, it is possible that at the next meeting on June 19, the country's central bank will reduce the key rate from 0.25% to 0% or even to a negative value, and then banks will have to almost pay extra to clients who want to take out a loan.

The current interest rate is the lowest since September 2022. However, if it were not for the rise in housing prices, negative inflation could have hit Switzerland as early as April 2024. The strengthening of the Swiss franc occurred, according to experts, due to a decrease in the cost of imported goods, including energy. The national currency strengthened after the tariffs introduced by D. Trump. Experts believe that after this, investors began to invest in the Swiss currency.

There are currently no countries in the world with a negative key rate, but this has happened at different times. For example, in Denmark and Japan. In 2019, the Danish bank Nordea Bank Abp began issuing mortgages with a zero interest rate. The only condition for receiving such a loan is a long loan term (at least 20 years). Against this background, another Danish bank, Jyske Bank, promised to issue mortgages at a rate of minus 0.5% per annum. That is, in this case, the lender would pay extra to borrowers who decided to buy a new home. When repaying the loan, the borrower would return a smaller amount than he took. It is important that the zero and negative rates were fixed for the entire term of the loan.

In Japan, the negative rate (minus 0.1%) was maintained from February 2016 to March 2024.

The Bank of Japan then set such a rate on new deposits that credit institutions placed in the Central Bank. That is, banks did not receive income from the funds they placed, but on the contrary, paid for their storage. In order to earn money, financial institutions were forced to invest money, including in the country's economy. During this period, carry trade operations using yen (yen carry trade) also became widespread. Investors took out loans from the Bank of Japan in Japanese yen and invested money in more profitable assets in other financial markets: for example, in bonds of American companies, Nvidia shares, Bitcoin, etc.

Since the yen was steadily declining, it was possible to earn money even by converting the Japanese currency into the US dollar, euro or Swiss franc. As Japan's economy emerged from a long deflationary spiral, the Bank of Japan abandoned its negative interest rate policy and raised it from -0.1% to 0.1%.